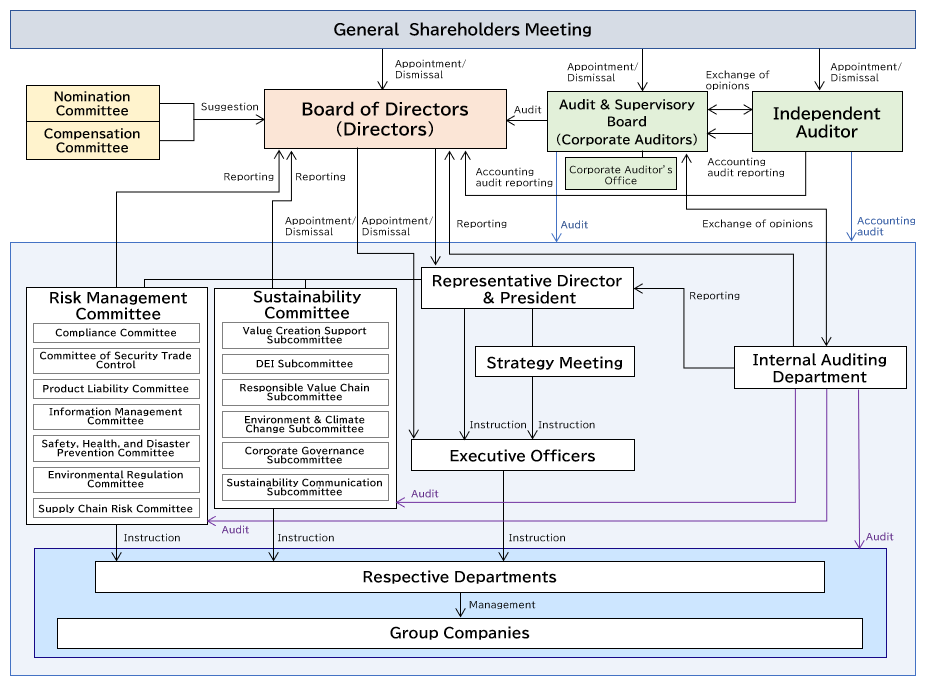

Corporate Governance Structure

Brother Industries, Ltd. (BIL) positions the Board of Directors as the organization that decides on basic management policies, makes high-level management decisions, and supervises the execution of operations. Therefore, we adopt the structure of a company with an Audit & Supervisory Board in the belief of its suitability for us. In addition, to ensure high transparency and objectivity, we have continuously enhanced our corporate governance structure. In order to enhance the management system focusing on sustainability, we established the Sustainability Committee in FY2022, which is chaired by the Representative Director & President, to conduct ongoing discussions on sustainability and report regularly to the Board of Directors.

Changes in Corporate Governance

| Year | Details of Reforms and Enhancements | Key Points |

|---|---|---|

| 2000 | Introduced the executive officer system | Separation of business execution and supervision |

| 2006 | Started appointing independent Outside Directors |

Enhancement of supervisory function |

| 2007 | Appointed female Directors | Diversified Board structure |

| 2008 | Appointed approximately half of the Board of Directors as independent Outside Directors | Enhancement of supervisory function |

| 2015 | Established the Brother Group Basic Policies on Corporate Governance | Strengthening of governance to contribute to the enhancement of corporate value |

| 2022 | Established the Sustainability Committee | Management system emphasis on sustainability |

Board of Directors

BIL's Board of Directors consists of 10 Directors (including five Outside Directors)*, one of whom is a female Director. In principle, meetings, which are chaired by the Director & Chairman, are held once each month. In FY2024, the Board of Directors met 13 times. To increase medium- to long-term corporate value, the Board formulates management strategies and plans and carries out decision-making on important executive operations. At the same time, the Board supervisesExecutive Officers in their operations, and strives to establish structures that ensure management soundness, such as the Group's internal control and risk management systems.

- As of June 25, 2025

Audit & Supervisory Board

The Audit & Supervisory Board consists of five Corporate Auditors (including three Outside Auditors)*1, of which two are female Corporate Auditors. It met 12 times in FY2024.

The Corporate Auditors have high levels of expertise in fields such as law and accounting, and following the audit standards established by the Audit & Supervisory Board, mainly conduct the audit activities given below, audit the Directors' execution of duties, and conduct audits on the state of establishment and implementation of the Group's internal control system.

Main activities

- Attendance of Board of Directors' meetings and voicing of opinions

- On-site audits of group companies and listening to reports

- Interviews and opinion exchange with Directors

- Interviews and opinion exchange with executive departments

- Regular exchange of information and opinions with the Internal Auditing Department and Accounting Auditors (such as three-way audit liaison conferences*2, and meetings for reports on financial results)

- As of June 25, 2025

- A collective name for three types of audits (audits by Corporate Auditors, audits by the Accounting Auditor, and internal audits)

Independent Outside Directors

BIL appoints several independent Outside Directors with extensive experience in corporate management to ensure objective and neutral oversight of management from an external point of view, and thereby strengthens its management oversight function. BIL's Independent Outside Directors provide management advice, decide important matters, and oversee executive operations based on their respective abundant experience, careers, and insights from perspectives independent of BIL's management.

Director Training and Support System for Outside Directors

BIL has created a system for providing training that it considers necessary for its Directors according to the training target, and it conducts training based on the system. As training for Outside Directors, we provide them with not only information about our businesses, history, financial operations, organization, etc. but also opportunities to inspect our on-site operations in person, including visits to our facilities in and outside of Japan, thereby deepening their understanding of our businesses. To train Internal Directors, we provide them with opportunities to acquire knowledge of the duties and responsibilities of Directors.

Executive Officer System

BIL has introduced an executive officer system to ensure swift decision-making by separating executive operations and supervision. There are 18 Executive Officers (including one female Executive Officer), four of whom (including two non-Japanese nationals)* concurrently serve as Directors of Group facilities as Group Executive Officers. Of the Executive Officers, four are concurrently Directors. Executive Officers—including Group Executive Officers—are elected by the Board of Directors. In accordance with the basic management policies determined by the Board, they make decisions on matters related to executive operations delegated by the Board and implement those decisions. At the same time, the Executive Officers are responsible for overseeing the operations of businesses, departments, and Group subsidiaries under their supervision.

- As of June 25, 2025

Nomination Committee and Compensation Committee

BIL has established the Nomination Committee and Compensation Committee as arbitrary advisory committees to the Board of Directors, in order to enhance the independence and objectivity of the functions of the Board of Directors regarding the appointment or removal and remuneration of Directors and Executive Officers. Each of the committees consists of six Directors*, including five Outside Directors as well as the Representative Director & President, and has appointed an Outside Director as its chairperson (Nomination Committee: Keisuke Takeuchi; Compensation Committee: Kazunari Uchida).

The Nomination Committee must deliberate on the agenda of the general meeting of shareholders concerning appointment or removal of Directors and the agenda of the Board of Directors concerning appointment or removal of executive officers in a fair, transparent, and strict manner before the agenda concerned are finalized, and report the outcome to the Board of Directors. The Nomination Committee also reports on matters such as succession planning for the President and other top management to the Board of Directors. In FY2024, the Nomination Committee met six times, with a 100% attendance of all committee members.

The Compensation Committee must discuss the contents of the Company rules concerning the standard for calculating the remuneration for Directors and executive officers, and the contents of respective remunerations of respective individuals, and report the outcome to the Board of Directors. In FY2024, the Compensation Committee met five times, with a 100% attendance of all committee members.

- As of June 25, 2025

Succession Plans for Top Management

BIL's Nomination Committee regularly considers succession plans for the President and other top management. The Nomination Committee, which is mainly composed of Outside Directors, considers and discusses such plans from a wide variety of viewpoints, such as requirements for management personnel according to management strategies and business environments and the development and appointment of human resources. The Committee's considerations and discussions, along with management personnel evaluations made through meetings with Executive Officers and other means, are reflected in the nomination of Directors and Executive Officers for each year.

Brother Industries, Ltd. Governance Structure (as of June 25, 2025)

Effectiveness of the Board of Directors

Conducting Evaluation of the Effectiveness of the Board of Directors

At BIL, respective directors and auditors every year evaluate the effectiveness of the Board of Directors and report the results to the Board of Directors. Based on the evaluation, the Board of Directors analyzes and assesses the effectiveness of the entire Board of Directors and discloses a summary of its results in a timely and appropriate manner.

The evaluation of the Board of Directors for FY2024 was conducted in February 2025 by having all Directors and Corporate Auditors answer a survey developed after seeking the opinions of external consultants. The survey's main questions are given below.

- Composition and operation of the Board of Directors

- Management plans and business strategies

- Corporate ethics and risk management

- Performance monitoring and evaluation and remuneration of the management

- Dialogues with shareholders, etc. and review of measures implemented in the previous year

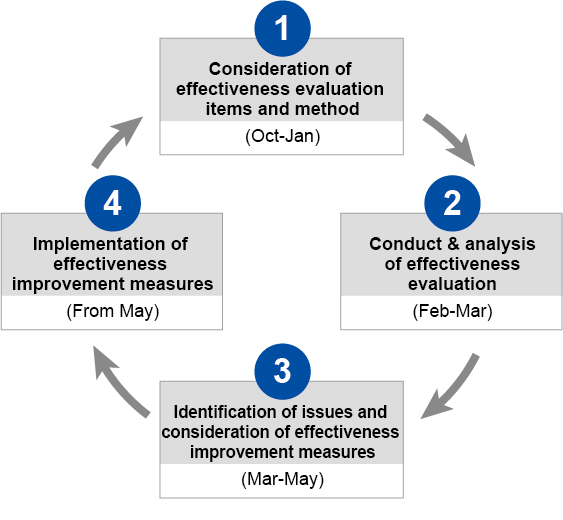

Process for Evaluation of the Effectiveness of the Board of Directors

To guarantee objective analysis, the consolidation of the survey and analysis of results are tasked to external consultants. The Board of Directors' secretariat conducts analysis using the consolidated data. A cycle is then implemented whereby analysis results, improvement measures, and other information is reported to and discussed by the Board of Directors, improvement measures are implemented, and re-evaluation is then conducted in the following year.

- Design of questions for measuring effectiveness of the Board of Directors together with external consultants taking into consideration factors such as social trends related to corporate governance.

- Evaluation regarding the effectiveness of the Board of Directors is conducted using a survey method for all Directors and Corporate Auditors. The survey's consolidation and analysis of results are tasked to external consultants. The survey response rate for FY2024 was 100%.

- The results of the survey are analyzed together with external consultants, identifying issues and proposing improvement measures to improve the effectiveness of the Board of Directors. The analysis results, improvement measures, and other matters are reported to the Board of Directors and discussed.

- After discussion by the Board of Directors, measures are implemented to improve the effectiveness of the Board of Directors. The effects of these efforts are confirmed by the Directors and Corporate Auditors during the following fiscal year's effectiveness evaluation survey.

Board of Directors' Effectiveness Evaluation Results and Response Policy

At the meeting of the Board of Directors held in May 2025, the evaluation results were discussed, and it was confirmed that BIL's Board of Directors was functioning effectively in general. In consideration of opinions and requests shared through the latest survey for the evaluation of the Board of Directors, the following initiatives will be implemented in FY2025:

- Provide feedback to Executive Officers in the process of formulation of the next medium-term business strategy

- - "CS B2027" Report on the progress of four priority themes

- Continue to provide adequate information to officers

By implementing these initiatives, the Board of Directors will continue to improve its own effectiveness.

State of Improvement Regarding Past Evaluation Results

The results of the previous effectiveness evaluation of the Board of Directors in February 2024 confirmed that BIL's Board was functioning effectively overall. In response to the requests and the comments on areas for improvement received through the evaluation of the Board of Directors, the following measures were taken in FY2024.

- Hold discussions at meetings of the Board of Directors on key management themes and provide feedback to the executive team in the process of formulation of medium-term business strategies

- - Financial strategy, investment in human capital and human resources strategy

- Hold discussions at meetings of the Board of Directors on the ideal form of BIL's corporate governancers

Officer Remuneration

Policy on Officer Remuneration

BIL has established an officer remuneration system that facilitates the recruitment and retention of outstanding managerial talents from inside and outside the Company and serves the purpose of sustainably increasing corporate value. We have also adopted a policy of paying remuneration at appropriate levels according to job responsibilities and performance.

Starting from FY2025, the first year of our medium-term business strategy "CS B2027," we revised the calculation method of the performance-based and stock-based remuneration plans with the aim of continuously improving our corporate value.

The Company's Director remuneration is composed of the following:

| Type of remuneration | Eligible individuals | Details of remuneration |

|---|---|---|

| Basic remuneration | All Directors | A fixed amount of remuneration paid to all Directors |

| Annual bonus | Full-time Directors who concurrently serve as Executive Officers | Monetary remuneration linked to business performance in the relevant fiscal year |

| Stock-based remuneration | Directors other than Outside Directors and part-time Directors | Stock-based remuneration linked to medium-term business performance and other factors (in cases where an eligible Director is a non-resident of Japan, alternative compensation is paid in the form of money) |

Full-time Directors who do not concurrently serve as executive Directors (excluding Outside Directors) are paid only basic remuneration and stock-based remuneration. Outside Directors and part-time Directors are paid only basic remuneration.

Objectivity

and transparency regarding the amounts and calculation methods of all forms of Director remuneration are insured by specifying them in detail in the Company's Director Remuneration Rules and Share Grant Rules (collectively referred to as the "Director

Remuneration Rules etc."). Revisions to the Director Remuneration Rules etc., require deliberation by the Compensation Committee and a resolution by the Board of Directors.

Remuneration paid to the Company's Corporate Auditors comprises

only basic remuneration, which is fixed-amount remuneration, and is prescribed in the Corporate Auditor Remuneration Rules established by the Audit & Supervisory Board.

Amounts and Calculation Methods of Officer Remuneration

Basic remuneration

Basic remuneration paid to Directors and Corporate Auditors is a fixed amount of remuneration and is determined corresponding to their positions and job responsibilities within a remuneration limit approved by the General Meeting of Shareholders. Basic remuneration paid to Directors and Corporate Auditors is limited to 400 million yen per year and 140 million yen per year respectively.

Annual bonuses

Annual bonuses paid to full-time Directors who concurrently serve as Executive Officers are limited to 0.4% of the amount of consolidated profit (profit for the period attributable to owners of the parent company) for each fiscal year and paid based on

reports of the Compensation Committee and resolutions of the Board of Directors.

Annual bonuses are calculated using the calculation method specified below. However, the total amount of annual bonuses paid in each fiscal year is limited to 0.4% of

the amount of consolidated profit for the relevant period. If as a result of the following calculation, the total payment amount exceeds this limit, the amount is adjusted to within the limit.

- In this section, "revenue" refers to consolidated revenue and "profit for the period" refers to profit for the period attributable to owners of the parent company.

- The "allocation ratio" is determined based on the sum of "base points" corresponding to the director's position and the predetermined "base point unit price" and "base profit for the period."

- Multiply the allocation ratio in (1) by the consolidated profit for the year to calculate the total annual bonus fund for the relevant fiscal year.

- Aggregate bonus fund is proportionally divided according to the base points for each position of each eligible Director, and the provisional distribution amount for each eligible Director is calculated.

- The Representative Director and President may propose a special supplementary amount of up to 10% of the provisional distribution amount for each Director eligible for payment, excluding himself.

- After the Compensation Committee examines the total provisional distribution amount and special supplementary amounts for each Director eligible for payment and the total payment amount, the Committee submits to the Board of Directors a proposal on the annual bonus payment amount for each Director eligible for payment, and payment is made to each eligible Director pursuant to a resolution of the Board of Directors.

Stock-based remuneration

Stock-based remuneration is variable remuneration linked to the degree of attainment of medium-term strategies and so on and the degree of increase in shareholder value in order to provide incentives to contribute to enhancing the Company's corporate value over the medium to long term. Stock-based remuneration makes use of a share grant trust mechanism whereby shares and other securities are granted to Directors eligible (excluding Outside Directors, part-time Directors, and Directors who are non-residents of Japan) for payment using a trust to which the Company contributes funds.

Shares and other securities are granted to eligible Directors as a rule after they leave their Director positions.

The number of shares granted as stock-based remuneration is calculated according to the predetermined formula.

- The Company grants to each eligible Director 50% of the number obtained by dividing the predetermined base amount of stock-based remuneration by the base stock price according to the Director's position in the Company as fixed points and 50% as performance-linked points for the period covered by the medium-term strategy, etc. (referred to simply as the "applicable period") in each fiscal year, and the points accumulate.

- After termination of the applicable period, the cumulative number of performance-linked points is calculated for each Director according to the following formula and a final determination of the performance-linked point final value is made.

Formula

Performance-linked point final value = (A) + (B) + (C) + (D)

(A) Performance-linked cumulative value × 25% × ROE coefficient (* 1)

(B) Performance-linked cumulative value × 25% × TSR coefficient (* 2)

(C) Performance-linked cumulative value × 25% × Revenue coefficient (* 3)

(D) Performance-linked cumulative value × 25% × CO2 emissions reduction coefficient (* 4)

(*1) ROE Coefficient

-Calculated in accordance with the following table according to the degree of achievement of ROE target in the final fiscal year in the applicable period.

| Degree of Achievement | ROE coefficient |

|---|---|

| 130% or more | 200% |

| 100% to less than 130% | (Degree of achievement - 70%) ×10÷3 |

| 70% to less than 100% | Same as degree of achievement |

| Less than 70% | 0% |

(*2) TSR coefficient

-Calculated in accordance with the following table according to the comparison between our TSR and TOPIX (compare to TOPIX) during the applicable period.

Compare to TOPIX (%) = Our TSR ÷ TOPIX including dividends × 100

| Compare to TOPIX | TSR coefficient |

|---|---|

| 150% or more | 150% |

| 100% to less than 150% | Same as degree of achievement |

| Less than 100% | 0% |

(*3) Revenue coefficient

-Calculated in accordance with the following table according to the achievement rate of the target consolidated revenue for the final fiscal year of the target period.

| Degree of Achievement | Revenue coefficient |

|---|---|

| 150% or more | 150% |

| 75% to less than 150% | Same as degree of achievement |

| Less than 75% | 0% |

(*4) CO2 emissions reduction coefficient

-Calculated in accordance with the following table according to the degree of achievement of the CO2 emissions reduction amount target for Scope 1 and Scope 2 during the applicable period.

| Degree of Achievement | CO2 emissions reduction coefficient |

|---|---|

| 100% or more | 100% |

| 80% to less than 100% | Same as degree of achievement |

| Less than 80% | 0% |

- The Company's TSR indicates total shareholder returns including capital gains and dividends during the applicable period.

- In the case where a director leaves his/her position as Director before termination of the applicable period due to expiration of his/her term, an adjustment calculation is made based on the above.

- A director who satisfies the eligibility requirements to receive stock-based remuneration will receive 70% of the accumulated points granted based on (1) and (2) above after leaving his/her position and will receive monetary benefits equivalent to the remaining points.

The composition ratio of individual remuneration, etc. for each type of remuneration

The composition ratio of remuneration for each full-time Director who concurrently serves as an Executive Officer is as follows when actual values are in agreement with the short-term performance target, which is an indicator for the annual bonus, and the medium-term

performance target, which is an indicator for stock-based remuneration: Basic remuneration (fixed): Annual bonus (performance-based): Stock-based remuneration (performance-based)= generally 5 : 3 : 2

The composition ratio of remuneration for

each full-time Director who does not concurrently serve as an Executive Officer is as follows when actual values are in agreement with the medium-term performance target, which is an indicator for stock-based remuneration:

Basic remuneration

(fixed): Stock-based remuneration (performance-based) = generally 3 : 1

Clawback and Malus clause

With regard to annual bonuses and stock-based remuneration, in the case where a Director engaged in non-conforming conduct, accounting irregularities, or the like, the Company may demand that the Director return all or part of remuneration previously paid pursuant to a recommendation by the Compensation Committee and a decision of the Board of Directors.

The Compensation Committee's activities in the course of determining the amount of officer compensation

The Compensation Committee verifies the appropriateness of remuneration, etc., by position and category of Director and the total remuneration level with reference to objective remuneration level data from external research organizations on a regular basis each year.

As part of these activities, the Compensation Committee deliberated on the agenda items indicated below in FY2023.

| May 17, 2024 | Annual bonuses for Directors based on FY2023 performance Stock issuance based on FY2023 performance |

|---|---|

| December 23, 2024 | Officer remuneration level assessment Review (revision) of basic remuneration for officers |

| February 6, 2025 | Direction of review of the officer compensation system |

| February 27, 2025 | Review of officer basic remuneration, annual bonuses, and stock-based remuneration |

| March 24, 2025 | Revision of the officer compensation system |

The Board of Directors' activities in the course of determining the amount of officer compensation

The Board of Directors deliberated on and decided matters on officer remuneration for FY2024 as indicated below.

| June 25, 2024 | Remuneration for Directors for FY 2023 |

|---|---|

| March 24, 2025 | Revision of the officer compensation system |

Amounts of officer remuneration

(For one year from April 1, 2024 to March 31, 2025)

| Categories | Total amount of remuneration, etc. (Millions of yen) | Total amount by type of remuneration (Millions of yen) | Number of eligible officers | |||

|---|---|---|---|---|---|---|

| Basic remuneration | Annual bonus | Stock-based remuneration | ||||

| Basic remuneration | Performance-based remuneration | |||||

| Director(including Outside Directors) | 501 (63) |

311 (63) |

86 (-) |

47 (-) |

56 (-) |

11 (5) |

| Corporate Auditor(including Outside Auditors) | 81 (31) |

81 (31) |

- (-) |

- (-) |

- (-) |

5 (3) |

| Total(including Outside Directors and Outside Auditors) | 582 (95) |

393 (85) |

86 (-) |

47 (-) |

56 (-) |

16 (8) |

- The amount of remuneration paid to Directors does not include the employee salary portion for those employees who also serve as Directors.

- Performance-based remuneration related to stock-based remuneration is linked to the financial targets (revenue, profit for the year, CO2 emissions reduction, and TSR (compare toTOPIX) for FY 2024) of the former medium-term business strategy (FY 2022 to FY 2024), and the amount stated is the amount calculated by deducting the amount disclosed in the previous fiscal years from the amount calculated based on the degree of achievement of the performance targets.

For other information on officer remuneration, please see the Securities Report.

Officer Skills Matrix

BIL's Board of Directors is composed of various types of individuals with different knowledge and experiences to contribute to the sustainable management of the Brother Group's global business operations. BIL, placing importance on both supervisory and advisory functions of the Board of Directors, places particular emphasis on appointing Outside Directors who are independent of its management and who possess a wealth of management experience. For the Board of Directors as a whole, including those Outside Directors, we have created the Board of Directors' skills matrix after deliberation by the Nomination Committee and the Board of Directors, by organizing those who are expected to play a leading role in each skill that we consider necessary for the execution of our management strategy.

For the skills on the matrix, we selected

"Management/Strategy," "Development/Manufacturing," "Sales/Marketing," and "IT/DX" as skills related to business strategies, such as "business portfolio transformation" which is stated in our medium-term business strategy "CS B2027"; "Talent Development" as the foundation for these activities; "ESG/Sustainability" as a skill related to Materiality; and "Internationalism," "Legal/Compliance," and "Financial/Accounting" as skills related to global business development, governance, and finance.

(As of June 25, 2025)

| Role | Name | Official title or position | Committee to which he/she belongs | Area of Expertise | Age | Independent | Attendance | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nomination Committee | Compensation Committee | Business Strategy | Development/ Manufacturing |

Sales/ Marketing |

IT/ DX |

Talent Development | Internationalism | Legal/ Compliance |

Financial/ Accounting |

ESG/ Sustainability |

||||||

| Directors | Toshikazu Koike | Director & Chairman | ● | ● | ● | ● | ● | ● | 69 | 13/13 | ||||||

| Kazufumi Ikeda | Representative Director & President | ● | ● | ● | ● | ● | ● | ● | ● | 62 | 13/13 | |||||

| Tadashi Ishiguro | Representative Director & Executive Vice President | ● | ● | ● | ● | 65 | 13/13 | |||||||||

| Satoru Kuwabara | Representative Director & Executive Vice President | ● | ● | ● | ● | ● | 62 | 13/13 | ||||||||

| Taizo Murakami | Director & Senior Managing Executive Officer | ● | ● | ● | ● | ● | 63 | 13/13 | ||||||||

| Keisuke Takeuchi | Outside Director | ● Committee Chairman |

● | ● | ● | ● | 77 | ● | 13/13 | |||||||

| Aya Shirai | Outside Director | ● | ● | ● | ● | ● | ● | 65 | ● | 13/13 | ||||||

| Kazunari Uchida | Outside Director | ● | ● Committee Chairman |

● | ● | ● | ● | 73 | ● | 13/13 | ||||||

| Naoki Hidaka | Outside Director | ● | ● | ● | ● | ● | 72 | ● | 13/13 | |||||||

| Masahiko Miyaki | Outside Director | ● | ● | ● | ● | ● | 71 | ● | 13/13 | |||||||

| Auditors | Keizo Obayashi | Standing Corporate Auditor | ● | ● | 62 | 13/13 | ||||||||||

| Takeshi Yamada | Standing Corporate Auditor | ● | ● | 62 | 13/13 | |||||||||||

| Akira Yamada | Outside Auditor | ● | ● | 72 | ● | 13/13 | ||||||||||

| Chika Matsumoto | Outside Auditor | ● | ● | 64 | ● | 13/13 | ||||||||||

| Ikuko Akamatsu | Outside Auditor | ● | ● | 57 | ● | - | ||||||||||

- The above information does not include all of the expertise possessed by each Director and Auditor.

| Name | Official title or position | Reason for Appointment | |

|---|---|---|---|

| Directors | Toshikazu Koike | Director & Chairman | Toshikazu Koike has produced excellent achievements and demonstrated outstanding qualities as a senior executive. With years of experience as the head of the Americas sales headquarters and President of Information & Document Company, he drove the growth of our primary printing business. As the President of the Company since 2007, he led the Group toward achieving our long-term business vision. Further since 2018, as the Chairman of the Board of the Company, he has been demonstrating his ability to promote corporate governance for the Group. It is therefore considered that his extensive insight and outstanding skills are essential to the operation of the Company. |

| Kazufumi Ikeda | Representative Director & President | After joining the Company, Kazufumi Ikeda worked in product planning, sales, and other departments and then was involved in business management and other operations at a German sales subsidiary. With years of experience as the head of the Americas sales headquarters, he drove the growth of our business in the Americas. After returning to Japan, he has promoted the medium-term business strategy as an executive responsible for corporate planning and has demonstrated outstanding leadership in human resources system reforms aimed at increasing employee engagement. We believe his extensive knowledge and excellent leadership will help contribute to the enhancement of our Group's corporate value. | |

| Tadashi Ishiguro | Representative Director & Executive Vice President | With years of experience as the head of the Americas sales headquarters, Tadashi Ishiguro has produced achievements in driving the growth of our business in the Americas. After returning to Japan, he formulated the medium-term business strategy as an executive responsible for corporate planning. Since 2017, he has greatly contributed to the performance of the Printing & Solutions Business as an executive responsible for the business division. It is therefore considered that his knowledge and experience will contribute to the growth of the Group's corporate value. | |

| Satoru Kuwabara | Representative Director & Executive Vice President | After joining the Company, with years of experience in development and design operations in our primary Printing & Solutions Business, Satoru Kuwabara demonstrated excellent leadership particularly in the development of laser printer products. From 2010, he served as an executive responsible for operating a manufacturing subsidiary in China as our main manufacturing facility. Since fiscal year 2021, he has driven the growth of the Printing & Solutions Business as an executive responsible for operating the business. It is therefore considered that his knowledge and experience will contribute to the growth of the Group's corporate value. | |

| Taizo Murakami | Director & Senior Managing Executive Officer | After joining the Company, Taizo Murakami has been engaged for many years in the manufacturing technology field in our main businesses, such as the sewing machine and printer businesses. He has extensive knowledge in the manufacturing and quality control fields of the Group from his work in positions including the head of the manufacturing facility in the ASEAN region. Most recently, he has been demonstrating his ability as an executive responsible for our quality and manufacturing functions in promoting the manufacturing technology strategy and manufacturing facility strategy, and in dealing with supply chain issues for business continuity. It is therefore considered that his knowledge and experience will contribute to the growth of the Group's corporate value. | |

| Keisuke Takeuchi | Outside Director | Mr. Keisuke Takeuchi has been engaged in the management of JGC Corporation (currently JGC Holdings Corporation) as President and Chairman of the company. Based on his extensive experience, achievements, and insight from this background as a senior executive of a global group of companies, it is considered that he can provide advice regarding the Group's management, make important decisions, and supervise the execution of business. | |

| Aya Shirai | Outside Director | Ms. Aya Shirai has been engaged in the management of various manufacturers with years of experience as an Outside Director. She has also been engaged in the top management of a local government and actively promoted the diversification of organizations. Based on her extensive experience, achievements, and insight from this background, it is considered that she can provide advice regarding the Group's management, make important decisions, and supervise the execution of business. | |

| Kazunari Uchida | Outside Director | Mr. Kazunari Uchida has extensive knowledge on corporate management as Japan representative of Boston Consulting Group and has been engaged in the management of various companies with years of experience as an Outside Director and an Outside Auditor. Based on his extensive experience, achievements, and insight from this background, it is considered that he can provide advice regarding the Group's management, make important decisions, and supervise the execution of business. | |

| Naoki Hidaka | Outside Director | Mr. Naoki Hidaka has been engaged in the management of a global group of companies through his experience as executive Vice President of Sumitomo Corporation and in the offices of the company outside of Japan. Based on his extensive experience, achievements, and insight from this background, it is considered that he can provide advice regarding the Group's management, make important decisions, and supervise the execution of business. | |

| Masahiko Miyaki | Outside Director | Mr. Masahiko Miyaki has been engaged in the management of a global group of companies as Executive Vice President of DENSO CORPORATION in such fields as technology development, quality, and the environment. Based on his extensive experience, achievements, and insight from this background, it is considered that he can provide advice regarding the Group's management, make important decisions, and supervise the execution of business. | |

| Auditors | Keizo Obayashi | Standing Corporate Auditor (Full-time) |

After joining the Company, Keizo Obayashi was engaged in operation and business management at information equipment department, corporate planning department, and European sales headquarters. He has the knowledge in accounting and tax fields through his experiences. Most recently, he has the experience in promoting the internal control of the Group as an executive responsible for the headquarters finance department. Based on his knowledge and experience, it is considered that he is the most appropriate for a Corporate Auditor of the Company. |

| Takeshi Yamada | Standing Corporate Auditor (Full-time) |

After joining the Company, Takeshi Yamada was engaged in corporate planning and administration at major subsidiaries in and outside of Japan. Most recently, as General Manager of the Corporate Planning Department, he has experience in business management including accounting at the Company and the Group companies. He also has extensive experience in management governance of the Group companies as a Director and Corporate Auditor of sales subsidiaries in Asian countries. Based on his knowledge and experience, it is considered that he is the most appropriate for a corporate auditor of the Company. | |

| Akira Yamada | Outside Auditor | With years of experience as a lawyer, Mr. Akira Yamada has been engaged in domestic and international corporate legal affairs. Based on his extensive experience, achievements, and insight, it is considered that he can provide auditing over the operation of the Company from a standpoint that is independent of our management executives. | |

| Chika Matsumoto | Outside Auditor | Ms. Chika Matsumoto has background with years of experience as a certified public accountant. Based on her extensive experience, achievements, and insight in the areas of finance and accounting, it is considered that she can provide auditing over the operation of the Company from a standpoint that is independent of our management executives. | |

| Ikuko Akamatsu | Outside Auditor | After building her career as a Certified Public Accountant and Certified Fraud Examiner, the candidate has further honed her expertise in the fields of governance, compliance, and diversity. In addition, she has been involved in corporate management as an outside officer for a wide variety of companies. Through her extensive experiences, insight and achievements, it is considered that she can provide auditing over the operation of the Company, independent of the managing executives. |

List of Officers

Corporate Governance Report [PDF/669KB] (Last update: June 26, 2025)