- Medium-Term Business Strategy

- Cost of Capital-Conscious Management

- Previous Medium-Term Business Strategy

CS B2027

The Brother Group has formulated the medium-term business strategy "CS B2027" for the period from FY2025 to FY2027 as a road map to achieve the Brother Group Vision "At your side 2030."

Medium-Term Business Strategy "CS B2027" detailed information

Outline of CS B2027

The Brother Group, under its group vision "At your side 2030" aimed for fiscal year 2030, defines its desired state as, "By being "At your side," we enable people's productivity and creativity, contribute to society, and help protect the earth. " Starting from this vision, the group indicates its methods of value provision and focus areas, striving for significant growth in industrial sectors and transformation in the printing domain. The mid-term strategy CS B2027, based on "Creating our future. Boldly." was formulated to achieve the Brother Group Vision "At your side 2030". We will accelerate business portfolio transformation for the enhancement of our corporate value over the long term, improving profit-generating capabilities.

CS B2027 aims to achieve sales revenue of 1 trillion yen and an operating profit of 100 billion yen, with a target ROE of 10%, by clarifying the roles of each business and executing strategies based on key indicators set for each business. The strategy also aims to increase the Industrial area sales revenue ratio to over 40% and Implement management with a focus on capital cost and share prices, targeting a TSR*1 of 100% or more compared to TOPIX. Over the three years, the group plans to execute growth investments of approximately 200 billion yen, focusing on M&A and alliances, to drive growth in the industrial sector. Additionally, investments will be continued to strengthen the management foundation supporting these transformations. Regarding shareholder returns, the group plans to significantly enhance returns, including the acquisition of 60 billion yen worth of treasury stock over three years, totaling 140 billion yen in returns.

To ensure the achievement of these goals, the following four key themes have been set:

Business-specific strategies

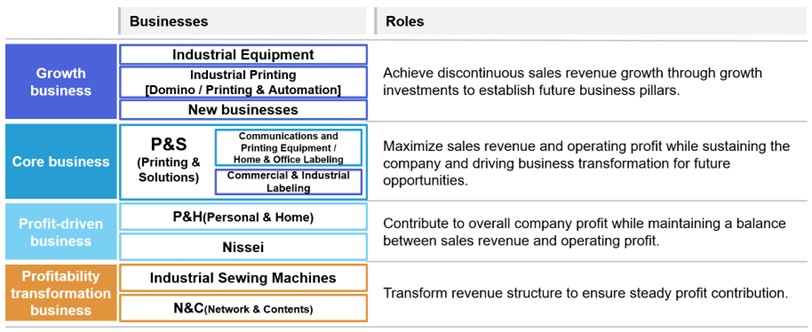

The Brother Group will classify its businesses into four categories, clarifying the role and key performance indicators for each. Investments and resources will be allocated according to these roles, and each business will execute strategies based on the key performance indicators to achieve the goals of CS B2027.

-

Growth business

The Brother Group positions businesses it intends to grow significantly company-wide as growth businesses. This specifically includes the Industrial Equipment business, the Industrial Printing business (which includes the Domino business and the Printing & Automation business), and New businesses, as well as Commercial & Industrial Labeling within the Printing & Solutions business (the "P&S business"). The key indicator for these businesses over the next three years is sales revenue. The group will actively consider growth investments, including M&A, to achieve discontinuous growth and establish future businesses pillars. It will also prioritize the allocation of human resources to these businesses. -

Core business

The P&S Business, excluding Commercial & Industrial Labeling, aims to maximize sales and profit, positioning itself as a core business that supports the revenue base across the company. Investments will be made to further strengthen market positioning and transform business models. The key indicator for this business over the next three years will be the amount of operating profit. -

Profit-driven business

The Personal & Home business and Nissei business are positioned as profit-driven businesses, enhancing profitability while balancing sales and profits to contribute to the group's overall earnings. The key indicator for these businesses is the operating profit margin. -

Profitability transformation business

The Industrial Sewing Machines business and Network & Contents business are positioned as profitability transformation business, with a thorough review of profit structures to ensure stable profit generation. The key indicator for these businesses is the operating profit margin, with efforts to improve profitability.

Financial Strategy

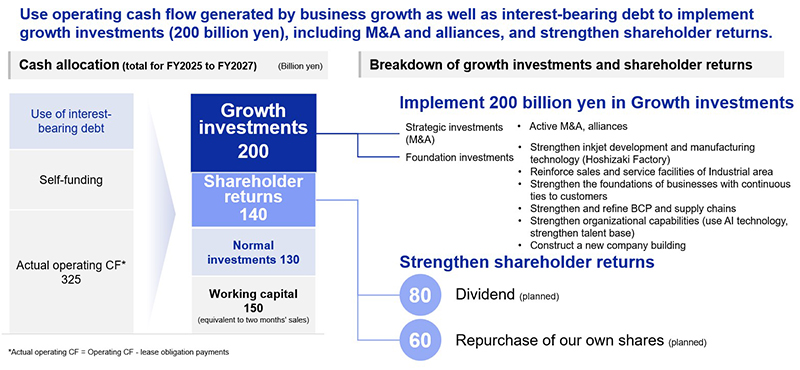

The Brother Group will promote management conscious of capital costs and stock prices, continuously enhancing shareholder value and maximizing corporate value. Operating cash flow generated from business growth and interest-bearing debt will be used for growth investments and significantly strengthening shareholder returns.

✓Growth investment

We will execute growth investments of approximately 200 billion yen, focusing on M&A and alliances, targeting areas such as machinery and factory automation, industrial printing, commercial & Industrial labeling , and new businesses, to strengthen the foundation and organizational capabilities for industrial sector growth.

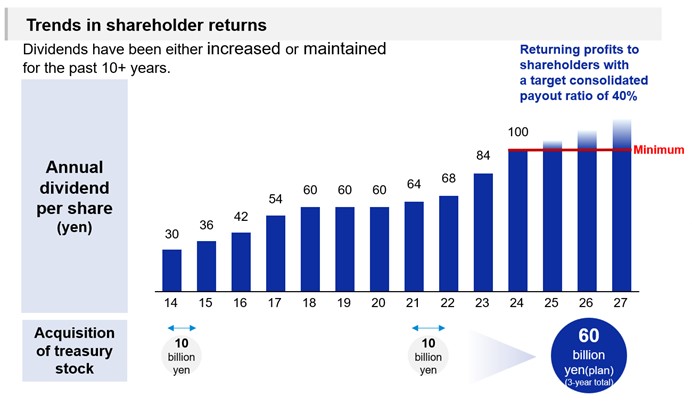

✓Shareholder returns

Regarding dividends, we will provide a minimum annual dividend of 100 yen per share, aiming for a payout ratio of 40%. Following the previous trend of increasing and maintaining dividends, we plan to further strengthen our basic policy of stable and continuous shareholder returns. Additionally, we plan to repurchase a total of 60 billion yen of our own shares during the CS B2027 period. Furthermore, we will consider additional returns based on performance and other factors.

The theme of CS B2027 is "Creating our future. Boldly." This reflects the group's commitment to not settle for the status quo and to boldly pave the way for the future. Through CS B2027, the Brother Group will accelerate its business portfolio transformation , improve profit-generating capabilities, and enhance our corporate value over the long term.

-

Total Shareholder Return (TSR)

An indicator that measures the overall return to investors (capital gains + dividends)